It's been an eventful week for the Lott clan. On Monday, Sen. Trent Lott (R-MS) announced that he'd be retiring late this year. The next day, FBI agents raided the law office of his brother-in-law, Richard "Dickie" Scruggs. Yesterday, Scruggs, his son, and three associates were indicted for bribery.

-- Paul Kiel atTPM Muckraker, Nov. 29, 2007

A search warrant was executed this week in the law office of Mississippi lawyer Dickie Scruggs. Barely a day later, he also was indicted on charges of bribing a state trial judge. Conservatives and liberals, alike, are chortling over what they imagine to be the imminent downfall of one of America's most successful, and richest, trial lawyers.

No surprise, really. Both sides see the event through partisan prisms that tend to blind one to the whole truth, whatever that turns out to be.

Republican neocom fanatics who reflexively side with corporate interests against individuals view "plaintiffs' lawyers" as bogeymen out to undermine America's capitalist foundation. As for Democratic Party liberals, it seems they can't see beyond the fact that the sister of Scruggs' wife is married to U.S. Senator Trent Lott, which makes the two men brothers-in-law. On no discernible evidence other than that, a good number of Lott critics are suggesting the Scruggs indictment explains why, just two days beforehand, the senior Mississippi senator announced that he intends to resign his seat before January rolls around.

Color us skeptical. It may be, as alleged, that a third man, also a lawyer, who supposedly offered a bribe to a Mississippi state judge was acting for Dickie Scruggs. Or, it may be that he wasn't. It may be that this other lawyer offered a bribe. Or, it may be the judge was fishing for a personal campaign contribution, as is the widespread practice among judges in that state.

With no proven facts to speak of yet, what we're left wondering is what does the known history of each side in this drama suggest about their motives and capabilities? On that score, we're ready to give more than the legal presumption of innocence to Scruggs. We give him the benefit of a doubt.

The most likely reason for Senator Lott's resignation, as it seems to us, has nothing to do with Scruggs or his family ties. It's more in harmony with Lott's character and political history that he simply doesn't want to wait an extra year to pig out on lobbyist fees.

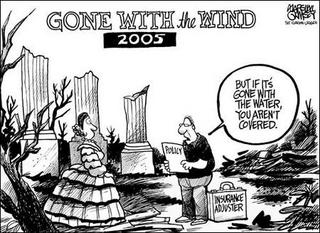

It's the political ties we find more intriguing. Dickie Scruggs and his law firm, as we have noted before, are among the leading litigators battling property insurance companies over their penurious -- some juries would say, even fraudulent -- handling of Hurricane Katrina claims. Scruggs undertook to represent well over a thousand devastated hurricane victims in Mississippi -- including that self-same brother-in-law, Trent Lott, who was the scourge of trial lawyers himself until he needed one. The Scruggs firm also led the way in knitting together a number of other law firms to form what's now known as The Katrina Group.

As Newsweek noted a few years ago, Scruggs has a long history of representing the little guy against the insurance industry and their corporate clients. He made his bones suing tobacco companies, then represented thousands of blue collar ship-builders afflicted with asbestosis. More recently, the intrepid lawyer added the health insurance industry to his list of targets.

One can surmise there are plenty of huge, well financed corporations out there who would happily contribute whatever it takes to see Dickie Scruggs brought down. If that isn't reason enough to reserve judgment at the news of his indictment, consider this:

- The indictment was engineered by U.S. Attorney Jim M. Greenlee in the Northern District of Mississippi. Greenlee has been a "loyal Bushie" U.S. attorney throughout the entire period

Karl RoveBush's lapdog, Alberto Gonzales, was busy politicizing the Justice Department. - Allegations of Justice Department "selective prosecution" and "targeting" of prominent Democratic party supporters across the nation have been at the heart of investigations by both the House Judiciary Committee and the U.S. Senate Judiciary Committee.

- It's already a matter of record that the Justice Department has been using "criminal prosecutions to help Republicans win elections" in Mississippi by selectively prosecuting Democrats. Although he's given to both parties, Scruggs is best known for being one of the largest individual contributors to Mississippi Democratic Party candidates.

- Barely three weeks ago, the Jackson Clarion-Ledger and other news sources began reporting that Scruggs was funding "a new attack ad on Republican insurance commissioner hopeful Mike Chaney." Last July, he gave a quarter of a million dollars to "Mississippians for Fair Elections, a PAC 'created to raise awareness about the role the insurance commissioner plays'" in Mississippi government.

- Last June, Scruggs filed a 100-plus page complaint in the Southern District of Mississippi, accusing State Farm Insurance Co. of a "racketeering enterprise" to suppress or destroy engineering reports it received from its own chosen expert evaluators that found insured homes had been damaged by high winds rather than flooding water. The allegation is the legal equivalent of nuclear war, potentially subjecting State Farm to treble damages and a host of other severe punishments.

- Just one day before the indictment was made public, Scruggs filed an amended complaint [pdf format] in the ongoing litigation. As described by Biloxi reporter Anita Lee "a team of policyholders' attorneys led by Richard 'Dickie' Scruggs" added new allegations that State Farm had actually financed the start-up of an engineering firm which then wrote hurricane damage reports with conclusions dictated by State Farm:

The owner of an engineering firm hoped to make up to $1.5 million over three months by adjusting Hurricane Katrina claims for State Farm, borrowing $150,000 and establishing a line of credit with State Farm Bank to set up shop on the Mississippi Coast in September 2005, according to records filed late Tuesday in federal court.

Because of the arrangement, Forensic Analysis & Engineering Corp. was beholden to State Farm, which wanted to minimize its Hurricane Katrina losses for wind damage, the lawsuit says. Another vendor that adjusted Katrina claims, the independent adjusting firm E.A. Renfroe & Co. Inc., at times owed 80 percent of its income to State Farm, the court records say.

- The 73-year old Calhoun County, Mississippi, judge, Henry Lackey, who claims a Scruggs intermediary tried to bribe him waited less than 48 hours before hitting the interview circuit to share his story with Rupert Murdoch's Wall Street Journal.

It may be difficult for folk living in a normal state, or even a politically subnormal state like Florida, to believe that the federal and state judicial systems in a place like Mississippi could be so bent that the weight of the law might be brought down on someone just because they belong to the wrong political party. But the erudite international lawyer and Harper's Magazine blogger, Scott Horton, has some familiarity with the depths to which his native South can sink.

He's been exposing the through-and-through corruption of Alabama's system for much of the past year, now. Here's a sampling. It isn't easy reading but it is eye opening.

Horton has occasionally remarked that things in neighboring Mississippi are much the same. As he wrote a few weeks ago:

In the last several months, we have looked in some detail at the prosecution of Democratic Governor Don E. Siegelman in Alabama. There is now substantial evidence that this prosecution was politically motivated, involving a number of key figures in the Alabama G.O.P., Karl Rove, U.S. attorneys in Birmingham and Montgomery, and political appointees at the Justice Department in Washington."For five years Washington has had a Department of Political Persecutions where the Department of Justice used to stand," Horton also has written.

* * *

[W]hile studying the Siegelman case, I have been looking over a series of cases in Mississippi which are remarkably similar to the Siegelman case in many ways. At this point I believe, based on documents and evidence which have come to me, that the Mississippi prosecutions will also shortly be exposed as being politically motivated and directed. In any event it is clear that they were designed to, and did, have a key role in influencing elections in Mississippi for the benefit of the Republican Party.

It is some measure of the damage done to the Justice Department under the Bush administration that one can even entertain the thought Scruggs' indictment may be politically inspired. But we know, now, that the Justice Department has perverted justice elesewhere for just that reason. The likelihood that's its happening again in Mississippi is too plausible to be dismissed.