Last Saturday's Pensacola News Journal carried an item by Michael Stewart about two local school districts' effort to 'borrow' money from the state against a theoretical judgment for back taxes on Pensacola Beach and Navarre Beach leaseholds. Why Santa Rosa County's school district needs to do this is something of a mystery, since the Navarre Beach tax suit now has been lost. But the Pensacola Beach lawsuit marches on.

Last Saturday's Pensacola News Journal carried an item by Michael Stewart about two local school districts' effort to 'borrow' money from the state against a theoretical judgment for back taxes on Pensacola Beach and Navarre Beach leaseholds. Why Santa Rosa County's school district needs to do this is something of a mystery, since the Navarre Beach tax suit now has been lost. But the Pensacola Beach lawsuit marches on.Yet, as Stewart reports, "How much money the districts can borrow is unclear."

"The Escambia School District could get as much as $6.9 million; Santa Rosa could get a loan of as much as $2.1 million.In other words, the county tax assessor's decision -- cheered on by our Escambia county commissioners -- to break long-standing promises of tax-free leases actually results in a reduction of state education funding to the Escambia County School District. Taxing beach property, it seems, would represent a windfall to the State, not the county. This is why the state has agreed to 'loan' money to the school district as long as it's paid back when and if taxes are imposed on island leaseholds.

* * *

In Escambia, the $6.9 million represents an annual $2.3 million shortfall for the 2004-05, 2005-06 and 2006-07 school years deducted when Pensacola Beach was placed on the tax rolls.

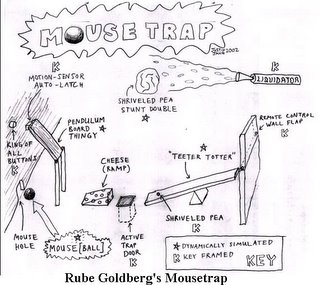

In Escambia County, when Pensacola Beach was added to the tax rolls, the state reduced the School District's yearly funding by $2.3 million, the estimated amount the new tax money would generate for Escambia schools.To explain why this is so would require a lengthy article all to itself about Florida's antiquated, unequal, highly politicized, and inadequate public education funding system. All we have to know for present purposes is that Florida' s system for funding public schools is as convoluted as a Rube Goldberg mousetrap. It short-changes school districts which happen to have a disproportionately high percentage of low-income students; and it well may be vulnerable to constitutional challenge.

But many beach residents chose not to pay until a lawsuit contesting the taxes is settled. If a judge rules the taxes are legal, beach residents will have to pay back taxes plus interest. If that happens, the School District will repay the interest-free loan.

If beach residents prevail, DOE would recalculate the School District's funding to make up for the shortfall, Arnold said.

What catches the eye in Stewart's article, though, has nothing to do with school funding issues. Twice he mentions the possibility of a "settlement" of the tax suit. It's possible Stewart simply made the common mistake of conflating "settlement" with "judgment," and he means nothing more than finality. Or, he could be hinting that true out-of-court settlement talks are underway.

Either way, Stewart's mention of a "settlement" recalls past efforts to amicably resolve out of court the long-standing tax dispute on the basis of a bargain that everyone could live with, beach residents and businesses as well as mainlanders.

What kind of deal might that be? For at least a decade, one group of beach leaseholders always favored trading taxes for an outright deed to leasehold property. Another group bitterly opposed any move toward compromise.

The split was mirrored among the membership of the Pensacola Beach Residents & Leaseholders Assn. While most PBRLA leaders at least privately favored negotiating a deed-for-taxes trade, none was able to marshall the support of enough beach residents and commercial leaseholders to make it happen.

Some PBRLA leaders who addressed the issue, like Ray O'Keefe (1998), argued that agreeing to pay taxes inevitably would lead to the desirable goal of self-government through municipal incorporation. Others like Don Ayres (1999) added that a deed-for-taxes solution also would improve the beach economy substantially by easing bank lender worries and by removing the uncertainty of leasehold renewal policies.

This last is an issue that has haunted the Santa Rosa Island Authority for many years. It's one that seems to be crawling out of its coffin once again, as we noted recently.

Still others, like Gary Smith (2004) recognized that a deed-for-taxes deal likely would satisfy the emotional need for security that many beach homeowners have, regardless of the common legal understanding that a deed is merely one kind of 'bundle of sticks' that other forms of property tenure, like a long term lease, closely approximate. Out of staters, in particular, are often puzzled by the leasehold tenure system on Pensacola Beach. Many potential buyers are scared off. Others simply accept the nonchalant assurances of real estate sales people that it's nothing to worry over.

It's been said that the revered "father of Pensacola Beach," the late Dr. Jim Morgan, also favored a deed-for-taxes solution. One surviving memorandum he wrote for posterity, decades ago, would seem to reflect this, although it also acknowledges that "granting the leaseholders absolute title will have consequences far beyond the taxation issue." (The only copy of the memo known to have survived was later edited by someone else, so it's impossible to be sure whether Morgan or the editor added the mysterious caveat.)

The closest anyone came to negotiating the kind of trade O'Keefe and Ayres (and maybe Morgan) favored came in the late 1990's, when county commissioner Mike Whitehead privately signalled that he would be open to a deed-for-taxes agreement as long as it happened within a few years. Whitehead ran for higher office soon afterwards, however. He lost and left the commission and was only recently elected once more as county commissioner.

With the adverse ruling on taxation of Navarre Beach leaseholds now final, some may assume that it is too late to settle the Pensacola Beach lawsuit. There are good reasons to reject that notion, however.

First among them is that a settlement with the right terms is in the interests of everyone. Even in the teeth of an adverse ruling, there would be plenty of basis for concluding that a true out-of-court settlement would be in the interests of mainlanders, county government, and state government, as well as beach residents.

Okalaoosa County solved the leasehold taxation issue decades ago when they traded beach taxes for a deed. Fort Walton Beach noticeably has prospered since then. One reason, perhaps, is that credit institutions often find it easier to lend money to businesses (or write mortgages for homes) that are secured by a deed to the property rather than a declining years lease. Residential as well as commercial real estate listings sell quicker, and probably for more, when buyers are assured the land tenure system is comparable to what they would find elsewhere, rather than the unique "99 year leasehold interest in Government owned land" that has prevailed on Pensacola Beach since the early 1950's.

A further reason is one of equity -- basically the same principle of fundamental fairness that led the courts in the Navarre Beach suit to conclude that long term leaseholds had so many incidents of ownership that they were the near-equivalent of deeded real estate and therefore taxable. If that is so, then to tax without a deed uniquely disadvantages beach property leaseholders.

Yet another reason is that a deed-for-taxes deal actually would bring in more money to the County than any court ruling. Under the Navarre Beach ruling, only improvements to the land -- house and business structures themselves -- are taxable. Until deeded outright, the land itself remains free of taxation. For those who would declare a beach residence as their homestead, that freedom has less value because the land tax they are avoiding would be less in any event. But for businesses, real estate taxes on deeded land will be just as deductible as a business expense as leasehold fees are today.

There are many more reasons for believing that all sides to the pending tax suits could benefit from a settlement. Undoubtedly, federal legislation along the same lines that enabled Okaloosa County to tax Fort Walton Beach property would be needed, however. The original deed to Santa Rosa Island prohibits Escambia County from titling the land in any other non-governmental peson or entity.

Former congressman Bob Sikes managed to eliminate that provision for the part of the island that is now called Okaloosa Island. Current congressman Jeff Miller has indicated in the past a willingness to sponsor such legislation for the rest of the island.

The lawyers and politicians entangled in the ongoing Pensacola Beach tax suit could do their clients and constituents a very large favor by approaching him again. A true settlement of the tax dispute would be in everyone's interests.

Dept. of Amplification

No comments:

Post a Comment