"Dick Cheney may be gone from the scene in 2008. But his legacy -- the occupation of Iraq, the outsourcing of vital government functions, and higher energy prices fueled in part by global instability and a refusal to commit to conservation -- will last long beyond that."A couple of technically unrelated articles today remind us how the entire 'Cheney administration', as Billmon persists in calling it, has dug our nation into a series of deep holes; and how administration principals, including Cheney, even now are trying to 'move past' that so they can dig us new, even deeper holes.-- Saniel Gross, "Lament of the Profiteer," Slate, Apr. 25

The first article appears in today's NYT, headlined "Rebuilding of Iraqi Pipeline as Disaster Waiting to Happen." It's all about how Dick Cheney's Halliburton Corporation and its subsidiary, KBR (formerly known as Kellogg Brown & Root), completely wasted over $75 million dollars trying to repair an oil pipeline in Iraq with an engineering technique that experts warned in advance wouldn't work in the locally unstable subsoil.

"No driller in his right mind would have gone ahead" with the project had they paid attention to the expert reports, an outside analyst later concluded. Sure enough, however, Cheney's alma mater, Halliburton, ignored the warnings. Moreover, as it continued to carry out the ill-conceived scheme, the subsidiary aped many of the uglier tactics of the Administration: it produce a string of optimistic progress reports... restricted subcontractors from communicating the truth to anyone ... "swept under the rug" early signs the project was failing miserably ... and ran up $200 million in claimed expenses which auditors have questioned.

Halliburton's drilling project, just like nearly everything attempted by the Bush Administration, was a failure. But the Halliburton subsidiary, KBR, was paid the contract price, anyway, plus a 4% "bonus fee."

As reporter James Glanz writes, the pipeline disaster could be "a metaphor for the entire $45 billion rebuilding effort in Iraq."

For that matter, it could be a parable for the entire sweep of administration ignorance, disregard for reality, contempt for the public interest, and runaway corporate greed.

The second story comes via Slate, which reports that Halliburton's "near monopoly on Pentagon business in Iraq" caused the company's earnings to "explode... from $5.1 billion in 2002 to $10.1 billion in 2005 -- about half of all Halliburton revenues." Nearly all of the growth, we are told, was due to government contracts awarded by the administration over the past five years. "The Middle East alone accounted for $6 billion of [Brown & Root] 2005 revenues."

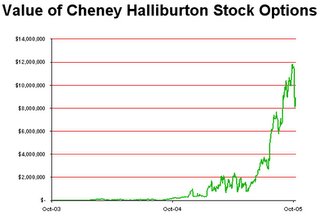

It's hardly news that Dick Cheney has been personally profiting from Halliburton at an astounding rate since becoming Bush's regent, even though he promised years ago to eliminate all conflicts of interest. As reported by Raw Story --

Cheney told "Meet the Press" in 2003 that he didn't have any financial ties to the firm.Dick Cheney, you should not be surprised to learn, was lying. In addition to his deferred salary, he continued to own over 1 million shares of Halliburton and at least another 435,000 in stock options through tax year 2005. Over that period, the value of his Halliburton options rose 3,281%. The options alone were worth $10 million in 2004.

“Since I left Halliburton to become George Bush's vice president, I've severed all my ties with the company, gotten rid of all my financial interest," the Vice President said. "I have no financial interest in Halliburton of any kind and haven't had, now, for over three years.”

Cheney continues to received a deferred salary from the company. According to financial disclosure forms, he was paid $205,298 in 2001; $162,392 in 2002; $178,437 in 2003; and $194,852 in 2004."

What is news is that late last year Cheney exercised many of his current grab-bag of stock options. This just happens to come at a fortuitous time, when KBR is about to go public; that is, KBR stock soon will be available for the public to buy.

What is news is that late last year Cheney exercised many of his current grab-bag of stock options. This just happens to come at a fortuitous time, when KBR is about to go public; that is, KBR stock soon will be available for the public to buy.Lucky us.

Most of the proceeds from the Initial Public Offering, the prospectus tell us, actually will be turned over to Halliburton:

We intend to use the net proceeds we receive from this offering to repay (i) [blank] millions [of] indebtedness... that we owe to Halliburton Energy Services, Inc., a subsidiary of Halliburton, under a demand promissory note executed in connection with our cash management arrangement with Halliburton, and (ii) indebtedness ... aggregating [blank] million that we owe to Halliburton Energy Services, Inc. under a subordinated intercompany note."So, should you buy KBR's stock?" Slate's investment writer, Daniel Gross, asks rhetorically.

It's certainly true that the IPO statement of risks in the prospectus, as Gross puts it, "reads more like a John le Carré novel than a financial document." The 201-page document filed with the SEC acknowledges allegations of cost overruns, kickbacks, bribes, corruption, murder, and more.

Still, he says, the stock should prosper in the years ahead, thanks largely to Cheney's "legacy" of an Iraq war, expensive "outsourcing" of domestic government functions, escalating oil prices, global instability, and "a refusal to commit to conservation." KBR's stock, Gross concludes, is "a leveraged bet on the Bush administration's continued incompetence at dealing with the twin issues of energy security and the Middle East."

In other words, if you like the holes Cheney has dug for the nation over the last five years, put your money where your mouth is and buy KBR stock. You might get rich from the nation's misfortunes.

And why not? Cheney did.

No comments:

Post a Comment